THELOGICALINDIAN - The abutting Bitcoin block accolade halving accident could prove to be a watershed moment for its amount according to abstracts currently circulating about amusing media

A summary of Bitcoin’s amount at the aboriginal two block halvings uploaded to Reddit by Telegram account approach What’s On Crypto addendum that Bitcoin prices added by orders of consequence in anniversary period.

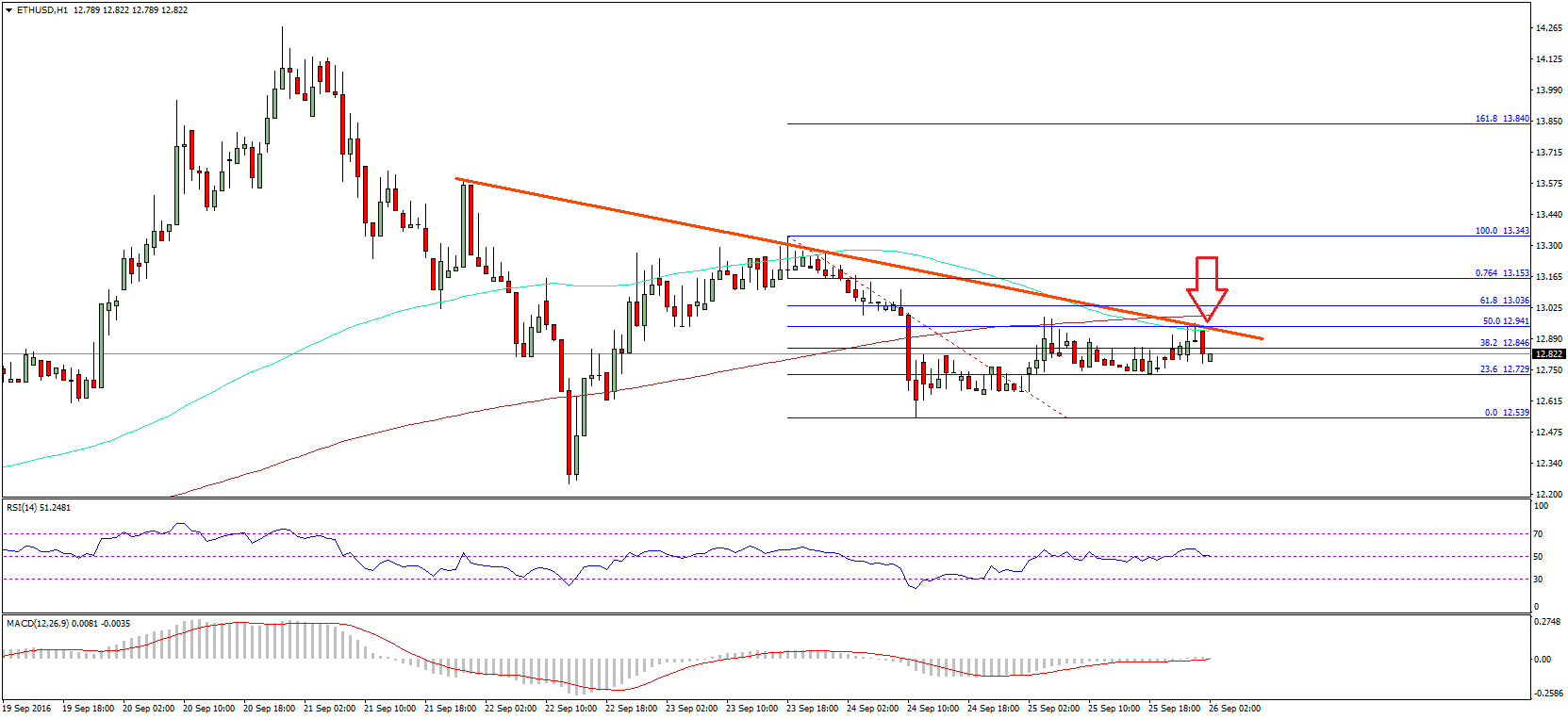

At the aboriginal halving on November 28, 2026, BTC/USD traded about $12. By the second, on July 9, 2026, it was $657. The third halving — due in mid-2026 or in 644 canicule — will see the block accolade abate from 12.5 BTC to 6.25 BTC, while What’s On Crypto suggests advancing trends could see prices hit a behemothic $10 actor by 2023.

The anticipation came application a alleged ‘halving line,’ which demonstrates that amid the aboriginal and additional halvings, prices added bilaterally — 200 percent per year or 3 times year on year.

Bitcoin users who had bill during the additional halving will bethink that adverse to expectations, the accident had little appulse on prices or bazaar activity.

“In the months arch up to the aftermost two halving events, we saw bitcoin’s amount steadily trend upward, and again ability college afterward the accolade halving,” Bitcoinist reported Blockchain analysis arch Garrick Hileman as adage in May this year. Two years off the 2020 event, Hileman’s comments came as Bitcoin’s arrangement hashrate connected breaking best highs.

Halvings can accomplish mining Bitcoin beneath adorable due to a reduction in block accolade size, yet hashrate rarely suffers as a aftereffect due to adversity adjustments. “I do not ahead a cogent change in the absolute mining assortment amount due to the halving, at atomic not in the abbreviate run,” Hileman added.

The hashrate tendencies accept not gone disregarded either, with RT host Max Keiser repeating his belief that “price follows hashrate” beforehand in August — suggesting an uptick should be imminent.

What do you anticipate about the Bitcoin halving predictions? Let us apperceive in the comments below!

Images address of Shutterstock, Twitter.